Passive income is exactly what it sounds like: periodic disbursements without significant effort beyond your initial investment.

While real estate has traditionally been considered a passive investment strategy, actively owning rental properties generally requires considerable effort, including overseeing the purchase, performing inspections, finding tenants and ongoing property management and maintenance.

On the Vairt platform, investors can invest in a variety of commercial real estate deals located across the country. The real estate companies manage the properties for you, providing a truly passive real estate investing experience.

Consistent passive income from monthly rental payments

Watch your investment grow as the property value appreciates

A traditional growth strategy leverages investments that may increase in value over the long haul. For buy-and-hold real estate investors, this means investing in properties with potential for appreciation, with the intention of profiting at the time of sale. Additionally, ideal properties may even offer quarterly distributions over the course of ownership.

With potentially lower volatility than the stock market and higher historic long-term gains, real estate investing can be attractive to growth investors. In select investments offered on the Vairt platform, distributions can be reinvested to leverage the potential of compound interest.

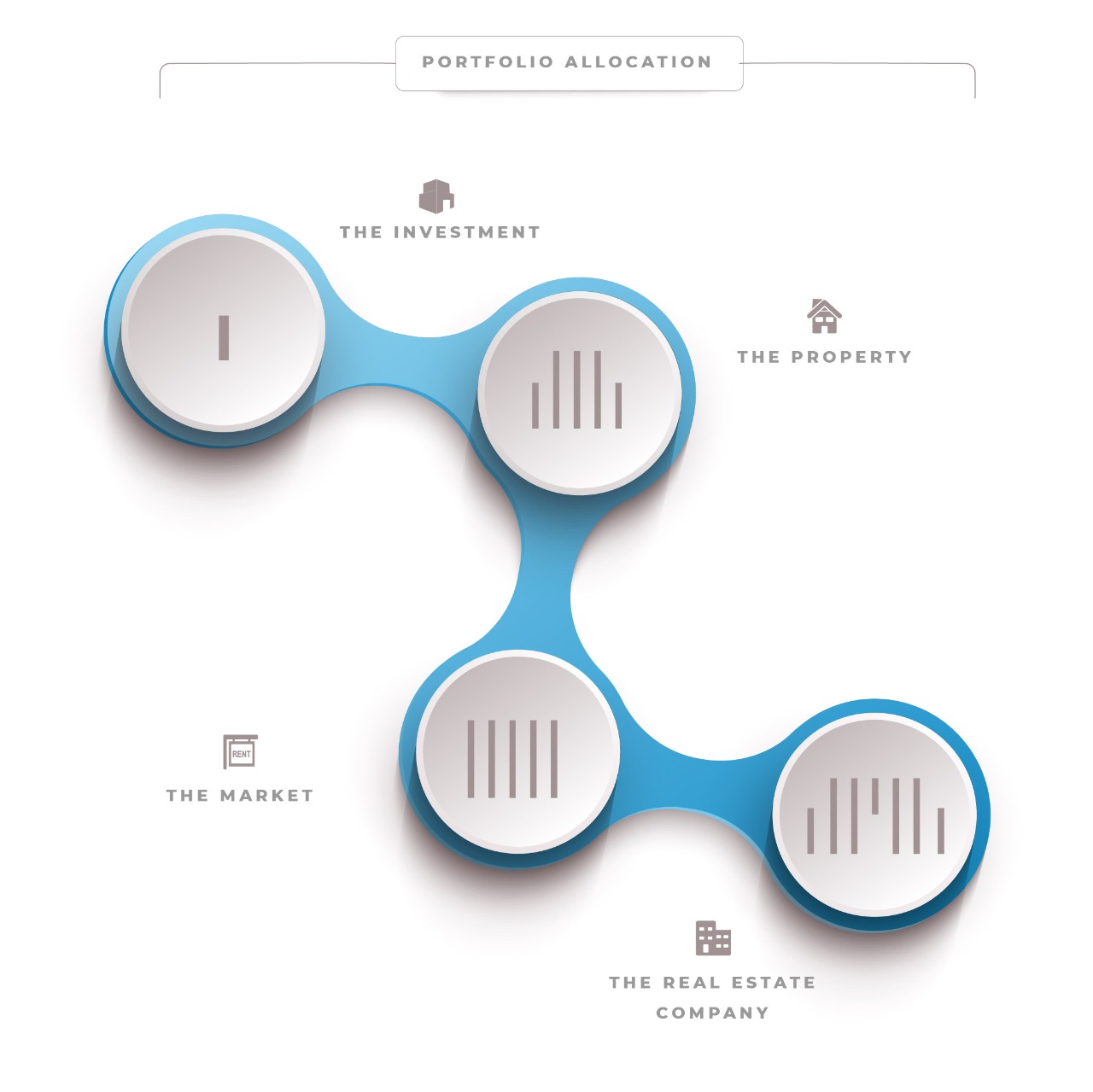

There are a variety of methods investors may use to determine their ideal portfolio allocation. But too often portfolios leave out an important asset – commercial real estate. While the appropriate allocation of will vary by investor based on their age, financial goals, or income, real estate is an important part of a diversified portfolio.